From Retirement Dreams To Reality

From Retirement Dreams To Reality

"A staggering 32% of Canadians aged 45-64 have saved nothing for retirement, underscoring the critical need for comprehensive financial planning." (Source: Canadian Payroll Association)

At Canadian Wealth Planners, we understand that securing your financial future is about more than just numbers; it's about peace of mind. For over 25 years, we've been guiding Canadians through retirement planning, estate management, and wealth preservation with a foundation built on trust, integrity, and unparalleled expertise

Whether you're seeking to optimize your retirement income, plan your estate, or safeguard your wealth against unforeseen health costs, our compassionate team is here to guide you every step of the way. Experience the difference that personalized, empathetic financial planning can make

Services

Retirement Planning

The journey to retirement is filled with uncertainties—how to ensure your savings last, cover healthcare costs, and maintain the lifestyle you've envisioned. At Canadian Wealth Planners, we see these challenges as opportunities to build a secure, fulfilling retirement. Our bespoke retirement planning services are designed to navigate the complexities of financial security, from creating sustainable income streams to comprehensive healthcare and estate planning.

Services

Retirement Planning

The journey to retirement is filled with uncertainties—how to ensure your savings last, cover healthcare costs, and maintain the lifestyle you've envisioned. At Canadian Wealth Planners, we see these challenges as opportunities to build a secure, fulfilling retirement. Our bespoke retirement planning services are designed to navigate the complexities of financial security, from creating sustainable income streams to comprehensive healthcare and estate planning.

Investments

Navigating the complexities of investments with concerns over safety, growth, and tax efficiency can be daunting for many Canadians. At our firm, we blend sophisticated risk management with strategic growth opportunities and tax-optimized investing to safeguard your funds while aiming for substantial growth. Our approach is designed to simplify the investment process, providing you with clarity and confidence in your financial journey. Let us guide you towards achieving your financial aspirations with tailored investment solutions.

Investments

Navigating the complexities of investments with concerns over safety, growth, and tax efficiency can be daunting for many Canadians. At our firm, we blend sophisticated risk management with strategic growth opportunities and tax-optimized investing to safeguard your funds while aiming for substantial growth. Our approach is designed to simplify the investment process, providing you with clarity and confidence in your financial journey. Let us guide you towards achieving your financial aspirations with tailored investment solutions

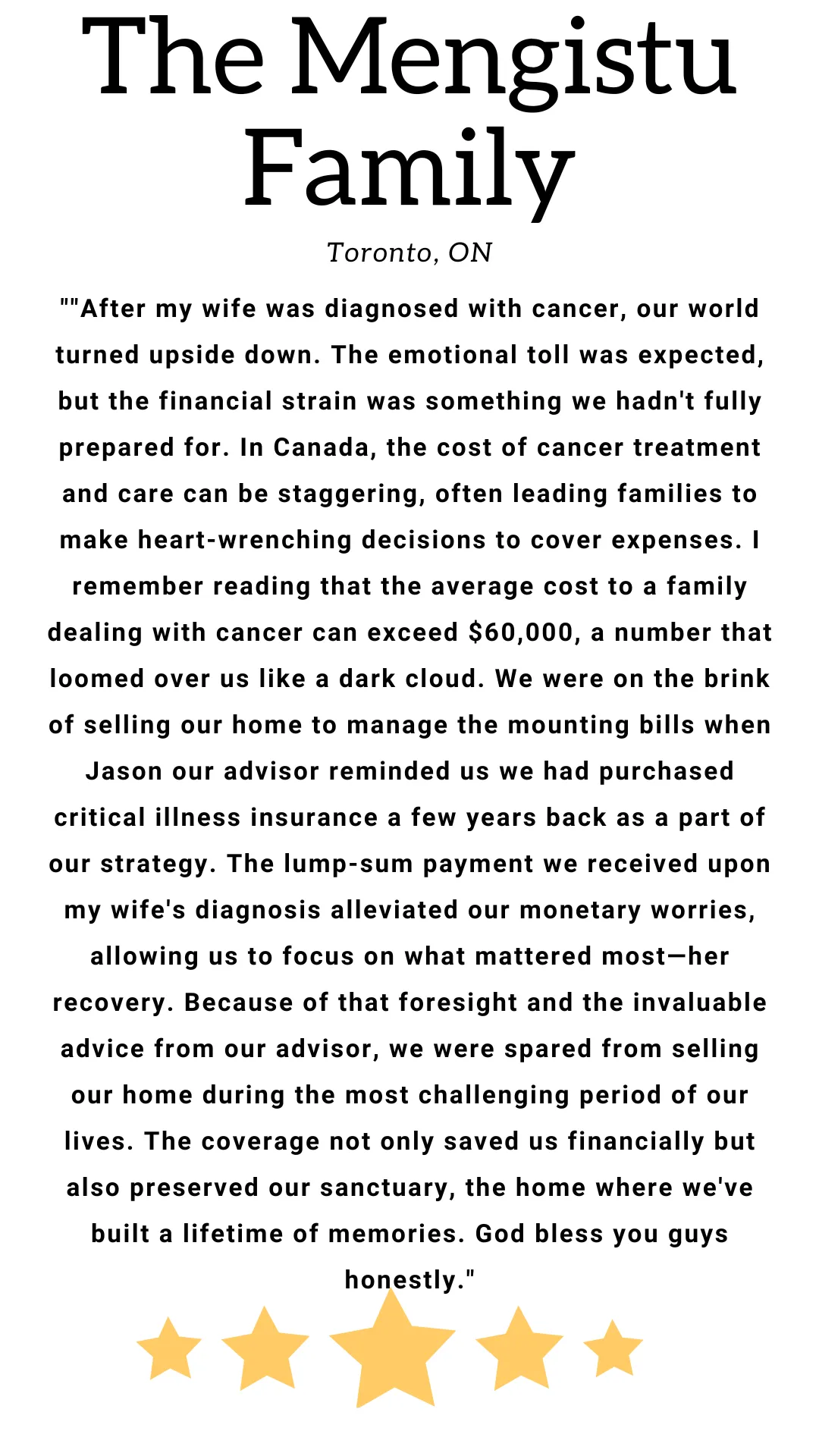

Living Benefits

Understanding the importance of financial protection against unexpected health events is crucial. Many Canadians worry about maintaining their lifestyle and meeting financial obligations in the face of serious illness or disability. Our living benefits solutions offer peace of mind, providing financial security when you need it most. Through tailored insurance options like critical illness insurance and disability insurance, we ensure you’re prepared for life’s uncertainties, preserving your financial independence and safeguarding your family’s well-being.

Living Benefits

Understanding the importance of financial protection against unexpected health events is crucial. Many Canadians worry about maintaining their lifestyle and meeting financial obligations in the face of serious illness or disability. Our living benefits solutions offer peace of mind, providing financial security when you need it most. Through tailored insurance options like critical illness insurance and disability insurance, we ensure you’re prepared for life’s uncertainties, preserving your financial independence and safeguarding your family’s well-being.

Estate Planning

For many Canadians, the thought of estate planning is intertwined with concerns about ensuring their legacy is preserved and passed on according to their wishes, all while minimizing taxes and avoiding family disputes. Our comprehensive estate planning services are designed to provide peace of mind by ensuring your assets are protected, your wishes are respected, and your loved ones are cared for. From wills and trusts to tax-efficient strategies and beneficiary designations, we tailor each plan to reflect your unique situation and goals.

"45% of Canadians will develop cancer in their lifetime (17.5 Million People), while another 25% of Canadians will die from cancer in their lifetime (9.7 Million People). Yet Less than 6% of Canadians Have Critical Illness Protection ! (2.5 Million People)" (Source: Canadian Cancer Society & Canadian Life and Health Insurance Association )

Estate Planning

For many Canadians, the thought of estate planning is intertwined with concerns about ensuring their legacy is preserved and passed on according to their wishes, all while minimizing taxes and avoiding family disputes. Our comprehensive estate planning services are designed to provide peace of mind by ensuring your assets are protected, your wishes are respected, and your loved ones are cared for. From wills and trusts to tax-efficient strategies and beneficiary designations, we tailor each plan to reflect your unique situation and goals.

"45% of Canadians will develop cancer in their lifetime (17.5 Million People), while another 25% of Canadians will die from cancer in their lifetime (9.7 Million People). Yet Less than 6% of Canadians Have Critical Illness Protection ! (2.5 Million People)" (Source: Canadian Cancer Society & Canadian Life and Health Insurance Association )

Critical Questions To Consider

Do you have a strategy to withdraw from your investments and Transfer Wealth to the Next Generation Tax Efficiently?

Do you have your money Properly Managed & is it Working as hard as You Are?

Anything can happen at anytime, with these volatile markets how do you secure your investments while allowing growth?

Are you or your family protected against Unforeseen events a.k.a (Emergencies) like Sudden Death or Sickness?

Do you really have enough funds to last your Whole Retirement & If not what should you do?

Do you want to control your Lifestyle, Income and Time (Financial Freedom)?

Some Of Our Trusted Partners

It Cost $0 To Speak With An Expert !

It Cost $0 To Speak With An Expert !

Plan Today, Thrive Tomorrow with Canada's Wealth Architects!

Start Planning Today, So You Can Thrive Tomorrow with Canada's Wealth Architects!

FAQS

DO I NEED TO PAY A FEE ?

At our firm, we take pride in offering our financial planning and advisory services without any direct fees to our clients. Instead of charging you for consultations, planning, or ongoing management, we receive compensation directly from the product providers when you choose to invest in or purchase a product through us. This model allows us to make high-quality financial advice accessible to a broader range of clients, regardless of their investment size or financial status.

Why is this beneficial for you?

>Accessibility: Our no-fee approach makes professional financial planning services accessible to everyone, not just those with substantial assets. This opens the door for more individuals and families to benefit from expert financial advice.

>Alignment of Interests: Since our compensation comes from the product providers, our success is directly linked to your satisfaction and financial success. This ensures that we are fully committed to recommending products that truly align with your needs and goals.

>Transparency: While we are compensated by product providers, we maintain a strict policy of transparency and honesty. We provide detailed explanations of each recommended product, including how we are compensated, so you can make informed decisions with complete confidence.

>Cost-Efficiency: Without the burden of direct fees, you can invest more of your resources into your financial goals. Our model eliminates the concern over hourly rates or percentage fees that can add up over time, making financial planning more cost-effective for you.

>Focus on Quality: Our reputation and business rely on the quality of the advice and products we recommend. This incentivizes us to continually seek the best possible financial solutions for you, ensuring your interests always come first.

We believe this approach to financial planning fosters a more transparent, client-centered relationship. By aligning our success with yours, we're committed to helping you achieve your financial dreams without the worry of additional fees. If you have any more questions about our no-fee structure or wish to understand more about how we're compensated, we're here to provide clear answers.

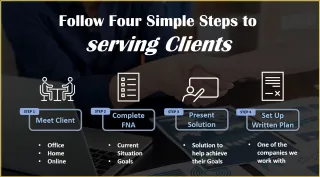

HOW DOES THE PROCESS WORK ?

Our approach begins with a detailed understanding of your financial goals, circumstances, and risk tolerance. We use this information to craft personalized financial plans that align with your unique objectives, employing a range of strategies and financial products tailored to you.

Step 1: Meet the Client

Objective: Establish a personal connection, understand the client's needs, and begin the trust-building process.

Process: The initial meeting can take place at our office, the client's home, or online, depending on convenience and preference. During this time, we get to know you personally, understand your immediate financial concerns, and start to build a comprehensive picture of your long-term aspirations.

Result: A comfortable and established relationship where clients feel understood and confident in our ability to address their financial needs.

Step 2: Complete Financial Needs Analysis (FNA)

Objective: Gain an in-depth understanding of the client’s current financial situation and their future goals.

Process: We conduct a thorough review of your current financial standing, including assets, liabilities, income, and expenses. We also discuss and document your short-term and long-term goals, investment preferences, and any other relevant information that can impact your financial strategy.

Result: A complete financial profile that forms the basis of a tailored financial plan, ensuring all recommendations are aligned with your personal objectives and financial situation.

Step 3: Present Solution

Objective: Provide a customized financial solution that addresses the client’s goals and mitigates their concerns.

Process: Based on the FNA, we develop and present a financial solution tailored to help you achieve your specific goals. This plan includes strategies for investments, savings, risk management, and any other services that align with your needs.

Result: A strategic plan designed to move you towards your financial goals, with a clear explanation of how each recommended action serves your interests and contributes to your financial well-being.

Step 4: Set Up Written Plan

Objective: Formalize the agreed-upon financial strategies into a detailed written plan.

Process: We document the discussed strategies, laying out a step-by-step action plan. This written plan includes timelines, expected outcomes, and benchmarks for success. It’s a living document that will evolve with your needs and market conditions.

Result: A comprehensive written financial plan that serves as a roadmap for your financial journey. It provides clarity, accountability, and a reference point that can be revisited and revised as needed.

WHAT MAKES OUR FIRM STAND OUT?

Our commitment to providing personalized, educated financial guidance sets us apart. We empower our clients with the knowledge to understand their financial options and make informed decisions. Plus, our wide range of financial products ensures you have the best tools at your disposal to achieve your dreams.

CAN WE HELP WITH DEBT MANAGEMENT AND BUDGETING ?

Yes, we offer guidance on debt management and budgeting as part of our comprehensive financial planning services. Understanding that effective debt management and budgeting are foundational to achieving financial goals, we provide strategies and tools tailored to your unique situation, helping you reduce debt, manage expenses, and save more efficiently.

HOW DO WE SELECT FINANCIAL PRODUCTS TO RECOMMEND TO OUR CLIENTS ?

Our selection process is rigorous and client-focused. We evaluate a wide range of financial products from various providers based on performance, risk profile, costs, and alignment with our clients' goals. Only those products that meet our strict criteria for value and suitability make it into our recommendations. We prioritize your financial well-being and work diligently to ensure the recommendations we make serve your best interests.

HOW OFTEN WILL WE REVIEW YOUR FINANCIAL PLAN ?

We recommend reviewing your financial plan annually or whenever significant life events occur, such as marriage, the birth of a child, or retirement. This ensures your plan remains aligned with your evolving goals and circumstances.

Contact Us

Quick Links

Contact Us

+1 905-454-8254

Quick Links

Facebook

Instagram

X

LinkedIn